iPlanner.NET

Äri- ja finantsplaneerimise tarkvara

Äriplaani näide

TÕLKEBÜROO ÄRIPLAAN

Osaühing B & P Tõlkebüroo

04/04/2025 01:15:10(UTC)

1. Kokkuvõte

B&P Tõlkebüroo missiooniks on kvaliteetse tõlketeenuse osutamine soodsa hinnaga. Pakume kirjalikku ja suulist tõlketeenust Tartus, veebipõhiselt aga üle Eesti. Käesolev äriplaan on mõeldud esitamiseks EAS'ile, taotlemaks sihtfinantseeringut professionaalse tõlkeprogrammi soetamiseks.

Ettevõtte omanikud on Diana Baškirova ja Reeta Pere. Lisaks palgatakse tõlkebüroosse kaks tõlkijat, kellest üks hakkab tegema nii suulist- kui ka sünkroontõlget.

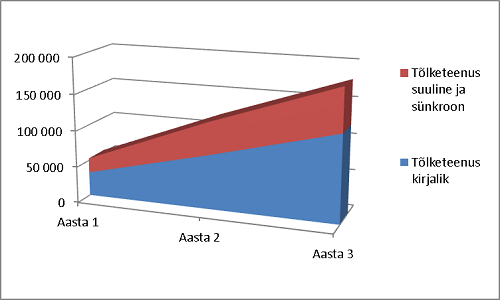

Müügitulu prognoos

Hinnad on meil soodsamad kui konkurentidel. Klientideks on ettevõtted ja eraisikud Eestist ning ka mujalt maailmast. Meie teenus on kättesaadav ka internetipõhiselt.

Meie esimese aasta eeldatavaks müügituluks on vähemalt 30 000 eurot ning kolmanda aastal on müügitulu sihiks 200 000 eurot. Kasumisse jõuame teisel aastal. Kolmanda aasta lõpuks soovime olla parim tõlkebüroo Tartus.

Osanike poolt sisse makstud kapital on 15 000 eurot.

| Main financial measures |

| 2022 | 2023 | 2024 | |

| Cash | 3,258 | 17,481 | 30,066 |

| Sales revenue | 33,000 | 120,000 | 180,000 |

| Net profit for financial year | -14,171 | 16,946 | 33,965 |

| Operating margin | -42.9% | 14.1% | 18.9% |

| Owners' equity | 829 | 17,775 | 35,940 |

| Return on equity (per year) | -1709% | 95.3% | 94.5% |

2. Meeskond ja juhtimine

Tõlkebüroo juhatuse liikmed ja osanikud on Diana Baškirova (hariduselt saksa keele filoloog) ja Reeta Pere (hariduselt inimgeograaf).

Reeta Pere on tõlkebüroo juhataja ja Diana Baškirova on tõlk. Täiskohaga tõlkijaid on kokku kolm ja neist igaüks oskab vähemalt kolme keelt: eesti keelt, vene keelt ning ühte võõrkeelt veel.

Ettevõtte ülesehitus

Rajame tõlkebüroo ja hakkame osutama kirjalikke ja suulisi tõlketeenuseid erinevates keeltes.

Tõlkebüroo asub Tartus, Riia mnt 10.

Tõlkebüroo eesotsas on juhataja, kellele alluvad kolm tõlkijat. Ka juhataja teeb 50% tööaja ulatuses tõlketööd. Suulise ja sünkroontõlke spetsialist palgatakse tööle esimese tegevusaasta viimases kvartalis.

Tulevikus soovime suurendada tõlkijate (töötajate) arvu ning ka tõlgitavate keelte arvu. Soovime võita ettevõtete/eraisikute usalduse, et nad hakkaksid meie püsiklientideks.

| Meie tiim |

3. Teenus/toode

Üha globaliseeruvas maailmas suureneb tõlketeenuste vajadus ning nõudlus. Sellest tulenevalt loome oma ettevõtte tõlketeenuste valdkonnas. Me eeldame, et juba ettevõtte tegutsemise alguskuudel on meie poolt pakutaval teenusel konkurentsivõimeline nõudlus. Juba praegu, äriplaani koostamise järgus, on meil tulevasi potentsiaalseid kliente.

Soovime pakkuda klientidele kvaliteetset teenust konkurentidest soodsama hinnaga. Järgnevalt tutvustame meie ettevõtte poolt pakutavaid teenuseid ja sihtruppe, meie konkurentsieeliseid ning müügi- ja töökorraldust.

Pakume kirjalikku ja suulist tõlketeenust kuues rohkesti kasutatavas keeles:

inglise-eesti-inglise (hind: 15,30 lk)

saksa-eesti-saksa (15,30 lk)

vene-eesti-vene (15,30 lk)

soome-eesti-soome (15,30 lk)

prantsuse-eesti-prantsuse (19,20 lk)

hispaani-eesti-hispaania (19,20 lk)

inglise-vene-inglise (hind: 15,30 lk)

saksa-vene-saksa (15,30 lk)

eesti-vene-eesti (15,30 lk)

soome-vene-soome (15,30 lk)

prantsuse-vene-prantsuse (19,20 lk)

hispaania-vene-hispaania (19,20 lk)

Kirjalik tõlketeenus on kättesaadav ka internetipõhiselt. Suulise tõlke hind sõltub tähemärkide arvust, keskmiselt tuleb hinnaks 21,70 lk.

Pakume tõlketeenuseid konkurentsivõimelise kvaliteediga, kuid soodsama hinnaga. Tõlketeenuse kiirus vastavalt tähemärkidele ja teksti raskusastmele, 3-8 lk päevas.

Tõlketöös kasutame tõlkeprogrammi SDL PerfectMatch, mis on oma hinnaklassi parim ja usaldusväärseim.

Tõlketeenuse hinna määrasime konkurentide toodete hindasid uurides. Me soovisime pakkuda odavamat tõlketeenust, kui seda pakuvad meie konkurendid. Sealjuures oleme kvaliteedi tasandil konkurentidega võrdsed.

Konkurentidel on kirjaliku tõlketeenus 16- 23 euro vahepeal ja enamuses firmades lisandub sellele veel käibemaks. Suulise tõlke hind konkurentidel tuleb aga palju kallim, kuskil 32 eurot lehekülg.

4. Klient, turg, konkurents

Tulevikus on oodata turu kasvu ja seda üha globaliseeruva maailma tõttu. Järjest enam muutuvad ärid globaalseteks või leiavad endale partnereid välisriikides ja paljud dokumendid ning muud paberid muutuvad võõrkeelseteks. Meie tulevased kliendid otsustavad meie poolt pakutava teenuse kasuks konkurentide ees, sest mel on hinna ja kvaliteedi suhe kõige mõistlikum. Meie teenuse puhul on hea see, et meil ei esine sessoonsust ega ka muid tsükleid. Tööd peaks olema aasta läbi ühtlaselt, aga eks igal teenusel/tootel on aegu, mil neid rohkem nõutakse ning mil vähem.

Meie potentsiaalsetest klientidest suurettevõtteid oleks Eestis kuskil 600, keskmise suurusega ettevõtteid 1000-5000 ning väikeettevõtteid ja mikroettevõtteid 60 000 ning riigiettevõtted. Lisaks lugematul arvul eraettevõtjaid. Välismaal on meie potentsiaalsete klientide arv väga suur.

Meie turu suurus on loodetavasti 50 suurettevõtet, 50 keskmise suurusega ettevõtet, 100 väikeettevõtet ja mikroettevõtet ning 50 eraisikust ettevõtjat.

Mujalt maailmast loodame leida kuskil 20 ettevõttet, kellel oleks meie teenust vaja ning püüame veenda neid just meie bürood valima.

Majandusharu ja turg

Meie teenuse turg on peamiselt Eesti-sisene, kuid loodame leia kliente ka mujalt maailmast. Turg on oodatavalt piisavalt suur, kuna globaliseeruvaid ettevõtteid on üha rohkem.

Meie Eesti-sisene turu suurus (potentsiaalselt) on 600 suurettevõtet, 1000-5000 keskmise suurusega ettevõtet, 60 000 väike- ja mikroettevõtet ning palju FIE-sid.

Tegelik turuosa ei pruugi alguses nii suur olla kui me loodame, kuid turu suurust ei saagi 100%selt määrata. Turg selle teenuse puhul on viimastel aastatel kasvanud ja turu kasvu ennustatakse ka tulevikus.

Võib öelda, et meie teenuse turg on nii hinnatundlik kui ka kvaliteeditundlik. Soovitakse soodsat, kuid väga kvaliteetset teenust.

Tegemist on pideva nõudlusega ja see peaks tagama meile ka pideva töö olemasolu.

Selles valdkonnas esineb kliendilojaalsust, sest ajaga ning hästi tehtud tööga kasvab usaldus.

Konkurentsieelised

Praegu on Tartus tegevad kuus suurt tõlkebürood: AD 3DOORS OÜ, European Media OÜ, Saag & Semevsky Keelestuudio, Tõlkebüroo Scriba, Siu Tõlkebüroo ja Lõuna-Eesti Tõlkekeskus ning lisaks mitmed väiksemad ettevõtted ja FIE-d.Konkurentide eeliseks on kogemus ja kindel klientuur, kuid nende nõrgaks küljeks on teenuse kallidus.

B&P Tõlkebüroo pakub konkurentidest soodsama hinnaga kvaliteetset ja kiiret kirjalikku ning suulist tõlketeenust. Erinevalt konkurentidest sisaldub meie tõlketeenuste hinnakirjas käibemaks. Teenuse kiiruse tagab võimalus osta teenust ka internetipõhiselt. Meie oodatava edu tagavad mõistlik hinna ja kvaliteedi suhe ning usaldusväärsus.

Pärast käesoleva äriplaani elluviimist võivad konkurendid hakata teenuse hindu langetama ning oma klientuuri kaitsma ning hoidma.

Meie firma saab olema juba töötavate ettevõtete seas konkureerival kohal.

Konkurentsieelise säilitamiseks lisandub meie keelte loetellu uusi keeli konkurentidest soodsama hinnaga.

Meie potentsiaalseteks konkurentideks on erinevad keeleinstituudid, mis pakuvad juba praegu vähesel määral tõlketeenust ning kindlasti ka välisriigis paiknevad tõlketeenust osutavad ettevõtted.

Konkurendid reklaamivad ennast ajalehtede veergudel ning suurematel firmadel on oma koduleht. Meie reklaamine ennast ajalehtedes ning mitmesuguste kommunikatsioonivahendite kaudu. Meil on olemas ka kodulehekülg, kust leiab kõik vajaliku informatsiooni "B&P Tõlkebüroo" kohta.

Konkurendid on suutnud tagada kvaliteetse teenuse, kuid kalli hinnaga. Meie püüame osutada sama kvaliteetset teenust, kuid seda odavama hinnaga. Konkurendid pakuvad kirjalikku tõlketeenust 15-19 eurot lk +km. Meil on kirjaliku tõlketeenus hind 15 eurot lk ja meie hind sisaldab juba käibemaksu. Suulise tõlke hind on konkurentidel kuskil 32 eurot lk, meil 22 eurot lk.

Meie ärialal on oodata tulevikus pigem konkurentsi tugevnemist, sest turu nõudluse kasv toob turule uusi konkurente.

5. Turundus ja müük

Turundustegevus

Loome ülevaatliku kodulehekülje ning reklaamime end erinevate meediakanalite teel: ajaleht, raadio ning otsepostitus potentsiaalsetele klientidele. Korralik töö tagab positiivse tagasiside, mis omakorda loob heakõlalise maine ja potentsiaalsed uued kliendid.Turustamine toimub kliendi ja tõlkija vahetus kontaktis.

Me kavatseme oma teenust reklaamida ajalehtede veergudel ja loome ka kodulehekülje. Ajalehtedes rekaalmime sellepärast, et seda loevad väga paljud inimesed ja paljudel ettevõtetel, kes on meie potentsiaalsed kliendid, on loodetavasti ajalehed tellitud.

6. Tegevuskava, riskianalüüs

Mõned meie töötajatest teevad tööd kodus ja mõned, kel pole võimalust kodus rahulikult töötada, töötavad meie Riia mnt l0 asuvas kontoris. Tõlketeenuse osutamiseks on vajalik SDL PerfectMatch programmi olemasolu. Tõlkeprogrammi annab töötajale ettevõte.

Meie teenuse tehnoloogia on väga kaasaegne ning oleme vägagi konkurentsivõimeline ning arenev ettevõte. Tõlkija tõlgib töö SDL PerfectMatch programmiga, mis on oma hinnaklassi parim ja ualdusväärseim. Lähimad konkurendid kasutavad sama hinnaklassi tõlkeprogramme, selles osas oleme võrdsed.

Tootmise eest vastutab juhataja ning ka tõlkijad ise. Meie nn tooraineks on tõlgitav tekst, mis tuleb meile otse klientidelt.

Töötajateks palkame võõrkeele haridusega inimesed, eelnev töökogemus pole hädavajalik, sest oleme arenev ettevõte. Töötajad õpivad kogemuste kaudu ning ajajooksul paraneb tõlketöö kiirus.

Riskid

Meie kõige suuremaks riskiks on see, et meil ei pruugi olla kohe äriga alustades piisavalt suur klientuuri ning me ei suuda täita oma loodetavat müügiplaan, et tõlkebürood tegevuses hoida. Riskiks on ka see, et tööd on suure mahuga ja sellest tulenevalt jõuab raha meieni ka hiljem ja me ei pruugi saada esimesel kuul piisavalt müügitulu, et kõiki kulusid katta.7. Finantsplaan

Ettevõtte alustamisel investeerivad omanikud põhikapitali sissemaksena 15 000 eurot (7500 eurot kummaltki osanikult). Lisaks annavad omanikud ettevõttele laenu kuni 6000 eurot, mis tagastatakse ühe-kahe aasta jooksul. Laenu intress on 5%.

Tõlkeprogrammi ostmisel kasutame ära EAS toetuse (sihtfinantseerimine 80% ulatuses).

| Sales revenue (EUR) |

| Products and services | Jan-2022 | Feb-2022 | Mar-2022 | Apr-2022 | May-2022 | Jun-2022 |

| Tõlketeenus kirjalik | 1,000 | 1,000 | 1,000 | 2,000 | 2,000 | 2,000 |

| Tõlketeenus suuline ja sünkroon | 0 | 0 | 0 | 0 | 0 | 0 |

| 1,000 | 1,000 | 1,000 | 2,000 | 2,000 | 2,000 |

| Sales revenue (EUR) |

| Products and services | Jul-2022 | Aug-2022 | Sep-2022 | Oct-2022 | Nov-2022 | Dec-2022 |

| Tõlketeenus kirjalik | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 |

| Tõlketeenus suuline ja sünkroon | 0 | 0 | 0 | 0 | 0 | 0 |

| 4,000 | 4,000 | 4,000 | 4,000 | 4,000 | 4,000 |

| Sales revenue (EUR) |

| Products and services | 2022 | 2023 | 2024 |

| Tõlketeenus kirjalik | 33,000 | 75,000 | 120,000 |

| Tõlketeenus suuline ja sünkroon | 0 | 45,000 | 60,000 |

| 33,000 | 120,000 | 180,000 |

| Gross margin (%) |

| Products and services | 2022 | 2023 | 2024 |

| Tõlketeenus kirjalik | 95 | 95 | 95 |

| Tõlketeenus suuline ja sünkroon | 95 | 95 | 95 |

| Cost of sales (EUR) |

| Products and services | 2022 | 2023 | 2024 |

| Tõlketeenus kirjalik | 1,650 | 3,750 | 6,000 |

| Tõlketeenus suuline ja sünkroon | 0 | 2,250 | 3,000 |

| 1,650 | 6,000 | 9,000 |

| Break-even analysis (EUR) |

| 2022 | 2023 | 2024 | |

| Sales revenue | 33,000 | 120,000 | 180,000 |

| Cost of sales | 1,650 | 6,000 | 9,000 |

| Variable expenses, total | 1,650 | 6,000 | 9,000 |

| Labour cost | 32,256 | 77,414 | 108,058 |

| Other operating expenses | 12,700 | 18,800 | 24,100 |

| Depreciation of fixed assets | 500 | 700 | 700 |

| Financial expenses | 225 | 300 | 138 |

| Fixed expenses, total | 45,681 | 97,214 | 132,995 |

| Gross margin | 95% | 95% | 95% |

| Break-even sales revenue | 48,085 | 102,331 | 139,995 |

| Sales revenue above break-even | 0 | 17,669 | 40,005 |

| Labour cost (EUR) |

| 2022 | 2023 | 2024 | |

| Wages and salaries | 24,000 | 57,600 | 80,400 |

| Social security costs | 8,256 | 19,814 | 27,658 |

| Labour cost | 32,256 | 77,414 | 108,058 |

| REVENUES | 33,160 | 120,160 | 180,160 |

| Labour cost to revenues | 97.3% | 64.4% | 60.0% |

| Other operating expenses (EUR) |

| Other operating expenses | 2022 | 2023 | 2024 |

| Ruumide kulu (inkubaatoris) | 2,000 | 2,400 | 3,600 |

| Kontoritarbed | 600 | 1,200 | 2,400 |

| Lähetused | 0 | 2,400 | 3,600 |

| Turundus | 5,000 | 6,000 | 6,000 |

| Raamatupidamine | 1,500 | 2,000 | 2,500 |

| Muud kulud | 3,600 | 4,800 | 6,000 |

| 12,700 | 18,800 | 24,100 |

| Purchase price (EUR) |

| Fixed assets | 2022 | 2023 | 2024 |

| Tõlkeprogramm | 2,000 | 0 | 0 |

| Arvutid jm kontoritehnika | 3,000 | 2,000 | 0 |

| 5,000 | 2,000 | 0 |

| Receipt of grant financing (assets) (EUR) |

| Fixed assets | 2022 | 2023 | 2024 |

| Tõlkeprogramm | 1,600 | 0 | 0 |

| Arvutid jm kontoritehnika | 0 | 0 | 0 |

| 1,600 | 0 | 0 |

| Cash flow statement (EUR) |

| Jan-2022 | Feb-2022 | Mar-2022 | Apr-2022 | May-2022 | Jun-2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||

| Inflows | ||||||

| Payments from customers, incl. VAT | 800 | 1,200 | 1,200 | 2,000 | 2,400 | 2,400 |

| Total | 800 | 1,200 | 1,200 | 2,000 | 2,400 | 2,400 |

| Outflows | ||||||

| Payments to vendors (goods), incl. VAT | 40 | 60 | 60 | 100 | 120 | 120 |

| Payment of salaries and wages | 1,667 | 2,000 | 2,000 | 2,000 | 2,000 | 2,000 |

| Social security costs | 688 | 688 | 688 | 688 | 688 | 688 |

| Payments to vendors (operating expenses), incl. VAT | 1,140 | 1,268 | 1,268 | 1,268 | 1,268 | 1,268 |

| Total | 3,535 | 4,016 | 4,016 | 4,056 | 4,076 | 4,076 |

| Net cash flow from operating activities | -2,735 | -2,816 | -2,816 | -2,056 | -1,676 | -1,676 |

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

| Inflows | ||||||

| Receipt of grant financing (assets) | 0 | 1,600 | 0 | 0 | 0 | 0 |

| Total | 0 | 1,600 | 0 | 0 | 0 | 0 |

| Outflows | ||||||

| Payments to vendors (assets), incl. VAT | 3,600 | 2,400 | 0 | 0 | 0 | 0 |

| Total | 3,600 | 2,400 | 0 | 0 | 0 | 0 |

| Net cash flow from investing activities | -3,600 | -800 | 0 | 0 | 0 | 0 |

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

| Inflows | ||||||

| Payments from shareholders | 15,000 | 0 | 0 | 0 | 0 | 0 |

| Loan amounts received | 0 | 0 | 0 | 6,000 | 0 | 0 |

| Total | 15,000 | 0 | 0 | 6,000 | 0 | 0 |

| Outflows | ||||||

| Principal repayments | 0 | 0 | 0 | 0 | 0 | 0 |

| Interest expense | 0 | 0 | 0 | 25 | 25 | 25 |

| Dividends (net to shareholders) | 0 | 0 | 0 | 0 | 0 | 0 |

| Payment of corporate income tax | 0 | 0 | 0 | 0 | 0 | 0 |

| Corporate income tax on dividends | 0 | 0 | 0 | 0 | 0 | 0 |

| VAT Return | 0 | 0 | -1,021 | 0 | 126 | 169 |

| Total | 0 | 0 | -1,021 | 25 | 151 | 194 |

| Net cash flow from financing activities | 15,000 | 0 | 1,021 | 5,975 | -151 | -194 |

| Net change in cash | 8,665 | -3,616 | -1,795 | 3,919 | -1,827 | -1,870 |

| Cash at the beginning | 0 | 8,665 | 5,049 | 3,254 | 7,172 | 5,345 |

| Cash at the end | 8,665 | 5,049 | 3,254 | 7,172 | 5,345 | 3,475 |

| Cash flow statement (EUR) |

| Jul-2022 | Aug-2022 | Sep-2022 | Oct-2022 | Nov-2022 | Dec-2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||

| Inflows | ||||||

| Payments from customers, incl. VAT | 4,000 | 4,800 | 4,800 | 4,800 | 4,800 | 4,800 |

| Total | 4,000 | 4,800 | 4,800 | 4,800 | 4,800 | 4,800 |

| Outflows | ||||||

| Payments to vendors (goods), incl. VAT | 200 | 240 | 240 | 240 | 240 | 240 |

| Payment of salaries and wages | 2,000 | 2,000 | 2,000 | 2,000 | 2,000 | 2,000 |

| Social security costs | 688 | 688 | 688 | 688 | 688 | 688 |

| Payments to vendors (operating expenses), incl. VAT | 1,268 | 1,268 | 1,268 | 1,268 | 1,268 | 1,286 |

| Total | 4,156 | 4,196 | 4,196 | 4,196 | 4,196 | 4,214 |

| Net cash flow from operating activities | -156 | 604 | 604 | 604 | 604 | 586 |

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

| Inflows | ||||||

| Outflows | ||||||

| Payments to vendors (assets), incl. VAT | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 0 | 0 | 0 | 0 | 0 | 0 |

| Net cash flow from investing activities | 0 | 0 | 0 | 0 | 0 | 0 |

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

| Inflows | ||||||

| Payments from shareholders | 0 | 0 | 0 | 0 | 0 | 0 |

| Loan amounts received | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 0 | 0 | 0 | 0 | 0 | 0 |

| Outflows | ||||||

| Principal repayments | 0 | 0 | 0 | 0 | 0 | 0 |

| Interest expense | 25 | 25 | 25 | 25 | 25 | 25 |

| Dividends (net to shareholders) | 0 | 0 | 0 | 0 | 0 | 0 |

| Payment of corporate income tax | 0 | 0 | 0 | 0 | 0 | 0 |

| Corporate income tax on dividends | 0 | 0 | 0 | 0 | 0 | 0 |

| VAT Return | 169 | 549 | 549 | 549 | 549 | 549 |

| Total | 194 | 574 | 574 | 574 | 574 | 574 |

| Net cash flow from financing activities | -194 | -574 | -574 | -574 | -574 | -574 |

| Net change in cash | -350 | 30 | 30 | 30 | 30 | 12.4 |

| Cash at the beginning | 3,475 | 3,125 | 3,155 | 3,185 | 3,215 | 3,245 |

| Cash at the end | 3,125 | 3,155 | 3,185 | 3,215 | 3,245 | 3,258 |

| Cash flow statement (EUR) |

| 2022 | 2023 | 2024 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |||

| Inflows | |||

| Payments from customers, incl. VAT | 38,000 | 140,266 | 215,334 |

| Total | 38,000 | 140,266 | 215,334 |

| Outflows | |||

| Payments to vendors (goods), incl. VAT | 1,900 | 7,013 | 10,767 |

| Payment of salaries and wages | 23,667 | 57,033 | 80,183 |

| Social security costs | 8,256 | 19,814 | 27,658 |

| Payments to vendors (operating expenses), incl. VAT | 15,110 | 22,515 | 28,852 |

| Total | 48,933 | 106,376 | 147,460 |

| Net cash flow from operating activities | -10,933 | 33,890 | 67,874 |

| CASH FLOWS FROM INVESTING ACTIVITIES | |||

| Inflows | |||

| Receipt of grant financing (assets) | 1,600 | 0 | 0 |

| Total | 1,600 | 0 | 0 |

| Outflows | |||

| Payments to vendors (assets), incl. VAT | 6,000 | 2,400 | 0 |

| Total | 6,000 | 2,400 | 0 |

| Net cash flow from investing activities | -4,400 | -2,400 | 0 |

| CASH FLOWS FROM FINANCING ACTIVITIES | |||

| Inflows | |||

| Payments from shareholders | 15,000 | 0 | 0 |

| Loan amounts received | 6,000 | 0 | 0 |

| Total | 21,000 | 0 | 0 |

| Outflows | |||

| Principal repayments | 0 | 0 | 6,000 |

| Interest expense | 225 | 300 | 138 |

| Dividends (net to shareholders) | 0 | 0 | 15,800 |

| Payment of corporate income tax | 0 | 0 | 0 |

| Corporate income tax on dividends | 0 | 0 | 4,200 |

| VAT Return | 2,185 | 16,967 | 29,151 |

| Total | 2,410 | 17,267 | 55,289 |

| Net cash flow from financing activities | 18,590 | -17,267 | -55,289 |

| Net change in cash | 3,258 | 14,224 | 12,585 |

| Cash at the beginning | 0 | 3,258 | 17,481 |

| Cash at the end | 3,258 | 17,481 | 30,066 |

| Income statement (EUR) |

| 2022 | 2023 | 2024 | |

| Sales revenue | 33,000 | 120,000 | 180,000 |

| Other operating revenue | 160 | 160 | 160 |

| Cost of sales | 1,650 | 6,000 | 9,000 |

| Other operating expenses | 12,700 | 18,800 | 24,100 |

| Labour cost | |||

| Wages and salaries | 24,000 | 57,600 | 80,400 |

| Social security costs | 8,256 | 19,814 | 27,658 |

| Total labour cost | 32,256 | 77,414 | 108,058 |

| Depreciation of fixed assets | 500 | 700 | 700 |

| Operating profit | -13,946 | 17,246 | 38,302 |

| Financial expenses | |||

| Interest expense | 225 | 300 | 138 |

| Total financial expenses | 225 | 300 | 138 |

| Profit before income tax | -14,171 | 16,946 | 38,165 |

| Income tax expense | 0 | 0 | 4,200 |

| Net profit for financial year | -14,171 | 16,946 | 33,965 |

| Balance sheet (EUR) |

| 2022 | 2023 | 2024 | |

| ASSETS | |||

| Current assets | |||

| Cash | 3,258 | 17,481 | 30,066 |

| Receivables and prepayments | |||

| Trade receivables | 1,600 | 5,334 | 6,000 |

| Inventories | |||

| Inventories | 0 | 0 | 0 |

| Total current assets | 4,858 | 22,815 | 36,066 |

| Fixed assets | |||

| Tangible assets | |||

| Machinery and equipment | 5,000 | 7,000 | 7,000 |

| Less: Accumulated depreciation | -500 | -1,200 | -1,900 |

| Total | 4,500 | 5,800 | 5,100 |

| Total fixed assets | 4,500 | 5,800 | 5,100 |

| Total assets | 9,358 | 28,615 | 41,166 |

| LIABILITIES and OWNERS' EQUITY | |||

| Liabilities | |||

| Current liabilities | |||

| Loan liabilities | |||

| Short-term loans and notes | 0 | 0 | 0 |

| Current portion of long-term loan liabilities | 0 | 6,000 | 0 |

| Total | 0 | 6,000 | 0 |

| Debts and prepayments | |||

| Trade creditors, goods | 80 | 267 | 300 |

| Trade creditors, other | 130 | 175 | 242 |

| Employee-related liabilities | 333 | 900 | 1,117 |

| VAT (GST) | 545 | 2,219 | 2,448 |

| Total | 1,089 | 3,560 | 4,107 |

| Total current liabilities | 1,089 | 9,560 | 4,107 |

| Long-term liabilities | |||

| Long-term loan liabilities | |||

| Loans, notes and financial lease payables | 6,000 | 0 | 0 |

| Deferred grant revenue | 1,440 | 1,280 | 1,120 |

| Total long-term liabilities | 7,440 | 1,280 | 1,120 |

| Total liabilities | 8,529 | 10,840 | 5,227 |

| Owners' equity | |||

| Share capital in nominal value | 15,000 | 15,000 | 15,000 |

| Share premium | 0 | 0 | 0 |

| Retained profit/loss | 0 | -14,171 | -13,025 |

| Current year profit | -14,171 | 16,946 | 33,965 |

| Total owners' equity | 829 | 17,775 | 35,940 |

| Total liabilities and owners' equity | 9,358 | 28,615 | 41,166 |

| Performance measures (EUR) |

| 2022 | 2023 | 2024 | |

| Sales revenue | 33,000 | 120,000 | 180,000 |

| Cost of sales | 1,650 | 6,000 | 9,000 |

| Gross profit | 31,350 | 114,000 | 171,000 |

| Other operating revenue and expenses | 160 | 160 | 160 |

| Other operating expenses | 12,700 | 18,800 | 24,100 |

| Labour cost | 32,256 | 77,414 | 108,058 |

| Depreciation of fixed assets | 500 | 700 | 700 |

| Operating profit | -13,946 | 17,246 | 38,302 |

| EBITDA | -13,446 | 17,946 | 39,002 |

| Financial income and expenses | -225 | -300 | -138 |

| Profit before income tax | -14,171 | 16,946 | 38,165 |

| Income tax expense | 0 | 0 | 4,200 |

| Profit | -14,171 | 16,946 | 33,965 |

| Operating margin | -42.9% | 14.1% | 18.9% |

| Gross margin | 95% | 95% | 95% |

| Sales per employee | 16,500 | 34,286 | 45,000 |

| Value added | 18,810 | 95,360 | 147,060 |

| Value added per employee | 9,405 | 27,246 | 36,765 |

| Return on equity (per year) | -1709% | 95.3% | 94.5% |

| Quick ratio | 4.46 | 2.39 | 8.78 |

| Current ratio | 4.46 | 2.39 | 8.78 |

| ISCR | -59.8 | 59.8 | 284 |

| DSCR | 0 | 59.8 | 6.35 |

| Debt to equity ratio | 7.24 | 0.34 | 0 |

| Debt to capital ratio | 87.9% | 25.2% | 0% |

| Receivables collection period, days | 17.5 | 16.0 | 12 |

| Payable period, days | 17.5 | 16.0 | 12 |

| Business value (EUR) |

| 2022 | 2023 | 2024 | |

| Net profit | -14,171 | 16,946 | 33,965 |

| Working capital (adjusted) | 677 | 2,374 | 2,794 |

| Change in working capital | 677 | 1,697 | 420 |

| Assets purchase value | 5,000 | 2,000 | 0 |

| Depreciation of fixed assets | 500 | 700 | 700 |

| Loan amounts received | 6,000 | 0 | 0 |

| Principal repayments | 0 | 0 | 6,000 |

| Free cash flow to equity (FCFE) | -13,348 | 13,949 | 28,245 |

| Present value of FCFE | -11,124 | 9,687 | 16,346 |

| Total present value of FCFE | 14,908 | ||

| Terminal value | 0 | 0 | 169,825 |

| Present value of terminal value | 98,278 | ||

| Business value | 113,187 | 0 | 0 |

This document was created with iPlanner.NET online business plan software

supported by Business Plan Samples

Document version: 04/04/2025 01:15:10 (UTC)