Home > Creating a Business Plan > Paid-in Capital

Paid-in Capital

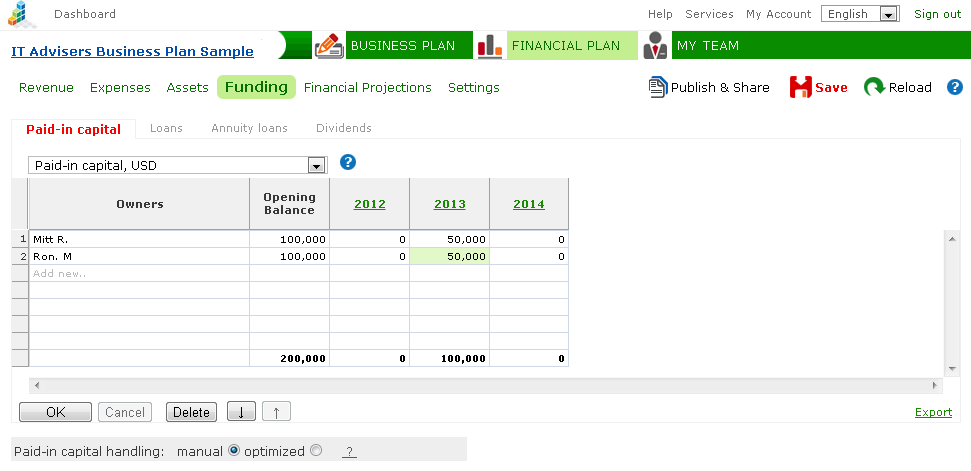

FINANCIAL PLAN > Funding > Paid-in capital

The "Paid-in capital" worksheet lets you plan the financial contribution of business owners to share capital.

Enter the list of business owners, and then the amount of contributions made by each. Click "OK".

Input parameters

Paid-in capital

|

Enter monetary contributions - cash receipts for shares.

If the contribution is non-monetary, the title entered could be something like "Non-monetary contribution", and the sum that corresponds to the monetary value of the asset. Then go to the Assets > Fixed assets worksheet and enter the purchase of fixed assets (name of assets, purchase price). Make sure that the time and value of transaction are the same for both entries.

In cases of ongoing business, enter a row like "Paid-in capital" and add a corresponding sum in the "Opening balance" column (see the image below).

|

Payment term

(days) |

Enter the payment term - the number of days a shareholder takes to pay for the stock or shares.

|

Premium rate

(%) |

A share premium is the amount paid in excess of a share's nominal value.

Example 1

Paid-in amount: 300,000

Premium rate: 200%

Share capital (nominal value): 300,000 / (1+200%) = 100,000

Share premium: 300,000 - 100,000 = 200,000

Example 2

Find the premium rate from known amount paid in and nominal value:

Premium rate = (300,000 / 100,000) - 1 = 200%

|

Entering past and future contributions

Optimization of paid-in capital

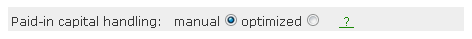

Paid-in capital contributions can be handled automatically with the software. See the "Paid-in capital handling" option under the input table.

| Manual method |

Paid-in capital contributions are entered manually. |

| Optimized method |

Paid-in capital contributions are handled automatically, based on cash flow predictions and avoiding negative cash balances.

The optimized method is accessible only when the table has only one owner's row.

|

See more

Opening Balances

Worksheet Features

Saving and Team Work

Publishing and Sharing

Team Building

|